“Travel is never a matter of money but of courage.”

– Paolo Coelho

Money Matters

Money Exchanging can be another dreaded detail. Let us guide you through the best way to do this at each and every International Airport in the world. Sometimes it is prudent to take a little of the local currency with you from home (usually this is never the case) but most likely we will advise you to use the ATM at the airport to gather a small amount of money to get you through the first day and then direct you to a bank, or in some cases, a money exchange booth in town. Don’t worry, we won’t send you to a black market money changer working out of a carpet shop in Kathmandu. We’d tried that and it’s not worth the two dollars savings. In fact, one of the reasons we provide Currency Exchange Advice is to assist you with the safest and most economical experience available.

ATMs

The most efficient way to exchange money from US Dollar into the currency of the country you are visiting is to exchange some money at an ATM upon arrival. We suggest only exchanging $100 – $200 and then changing more at a bank or ATM outside a bank in town. This may not always be the best bet, depending upon whether or not you will have access to a bank during the first days of your trip. ATMs do not have the best rate, but sometimes you have no choice and it is still a better rate than a Currency Exchange Booth at the Airport. All in all, ATMS are a good bet. Make sure to memorize your password if it is in letters instead of numbers because most foreign keypads are numerical only. Also make sure to grab your card when finishing a transaction. Yes, we’ve made both of these mistakes.

Apply for a Charles Schwab “Schwab” Debit Card and never pay an ATM Fee. That’s right. All savvy travelers have a Schwab Debit Card Account solely for travel purposes. Use this link for up to $1,000 sign up bonus. Details in link.

Credit Cards

Before your leave, make sure you contact your bank and let them know where you will be traveling, including the transit Airport. Double check during this call that your card does not have any Foreign Transaction Fees and if it does, do not bother using it on your trip (except in the case of an emergency). These days, all banking institutions offer a credit card without these fees which can be excruciating when you open the statement the next month.

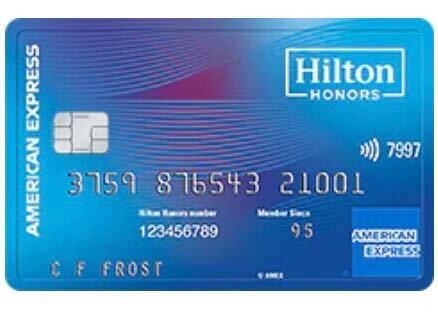

Suggested Cards

Currently we like the American Express Hilton Honors Credit Card. While it can’t be used everywhere in the world, neither can Visa or Mastercard. (Check out Alaska Airlines low annual fee Credit Card for a Visa Option). The reason we like this Amex Hilton Honors Card is that currently they offer 80,000 sign up points good for 4-5 hotel room nights –with no annual fee. (Plus we will get a few points for the referral to keep the website going.)